Have you ever added a Fixed Asset to your asset pool, and several months later added to the depreciable basis?

Maybe you’ve gotten the final freight charges or added more functionality to the original asset – but in either situation, you’re not extending the asset’s life.

You may not get the depreciation you expected if you don’t know about the “Depr. Acquisition Cost” and “Depr. Until FA Posting Date” fields.

Let’s take a closer look at your options.

Get in touch today and implement Fixed Assets in your Business Central solution.

Initial Acquisition Costs for a Fixed Asset

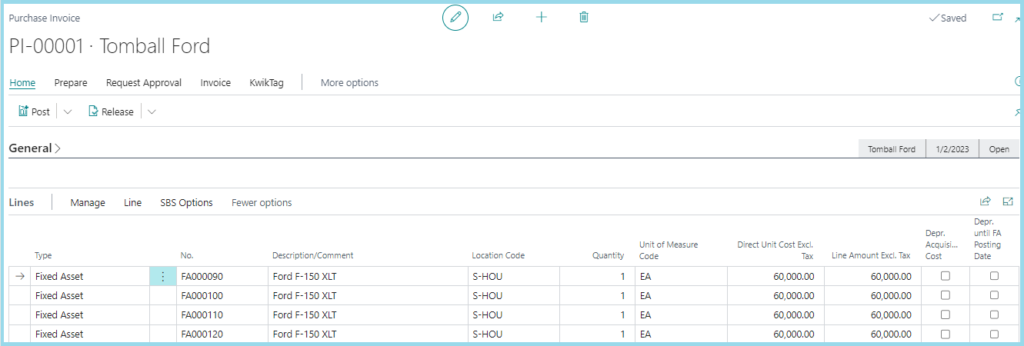

The Purchase Invoice shown below has four Ford F-150 Pickup Trucks all purchased on January 2, 2023.

Even though the trucks won’t go into service on the first day of the month, the company’s policy is to take a full month’s depreciation.

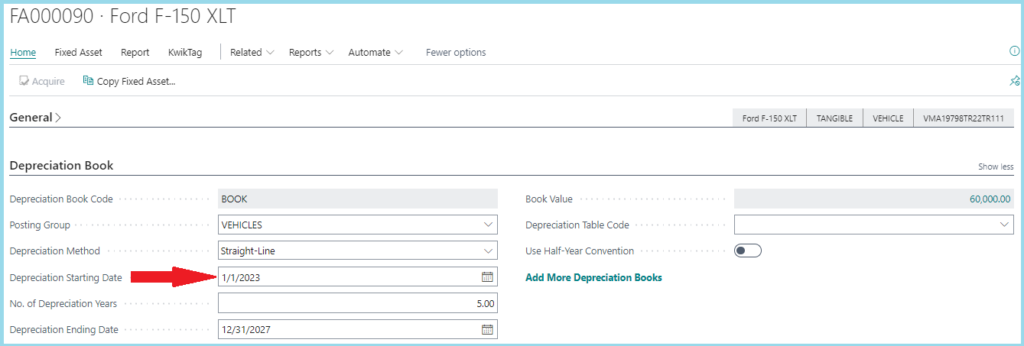

And that is based on Depreciation Starting Date in FA Depreciation Book.

NOTE: Based on the default setting on Deprecation Book, Business Central uses a 30-day month to calculate depreciation and rounds the depreciation to the nearest whole dollar.

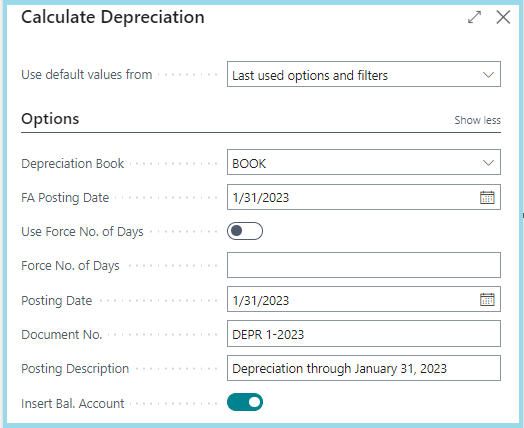

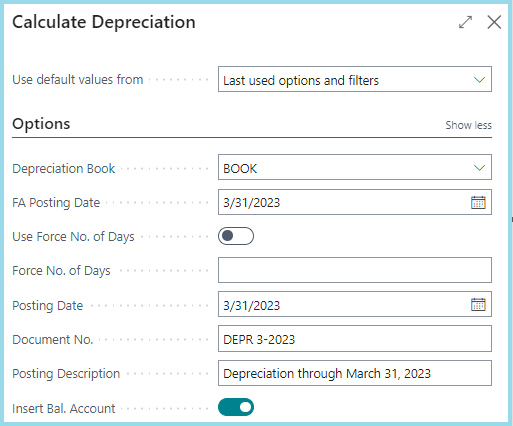

At the end of the month, we can use the following filters to calculate depreciation.

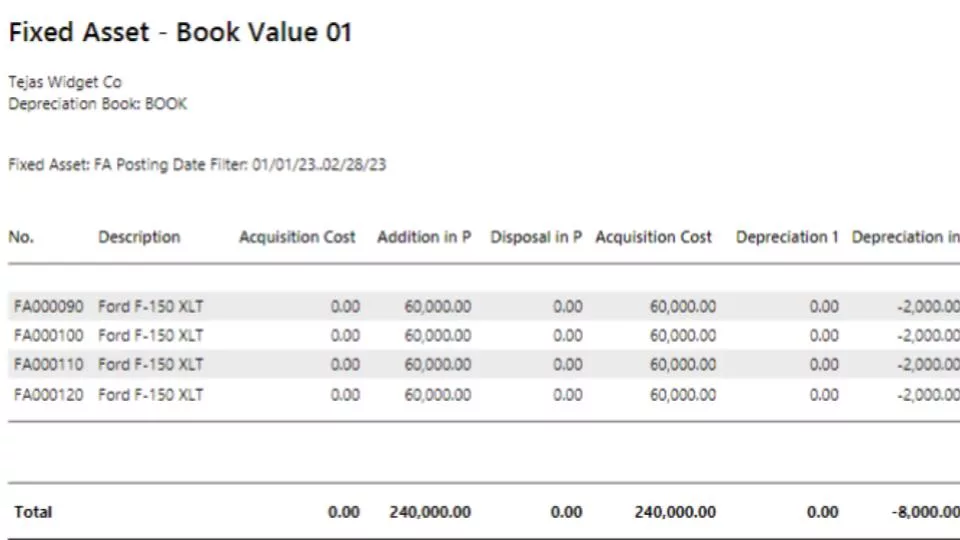

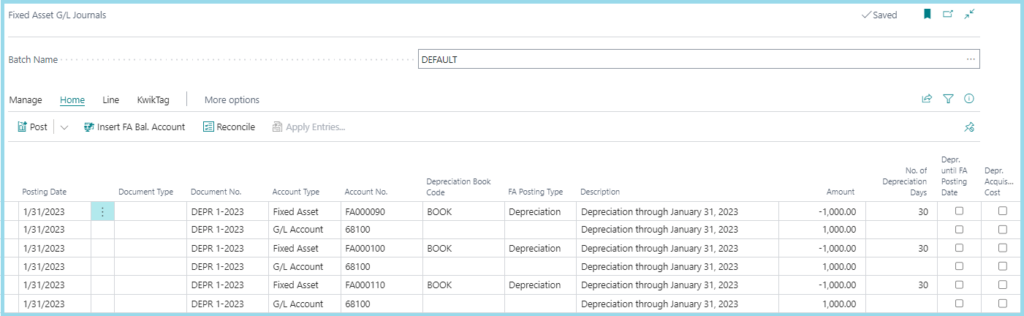

When depreciation is calculated for the first month the journal lines in the Fixed Asset G/L General Journal show monthly depreciation of [$60,000 / (12 months * 5 years)], or $1,000 for each truck.

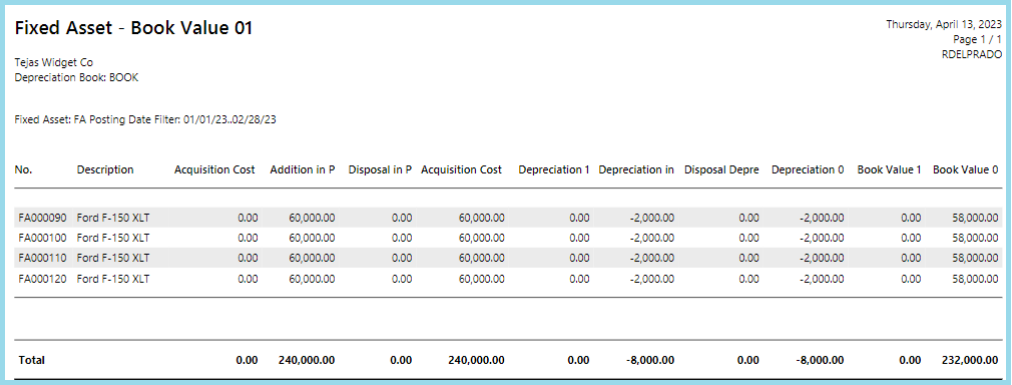

And after the first two months of ownership, the book value for each of these trucks is $58,000.

Additional Costs for an Existing Fixed Asset

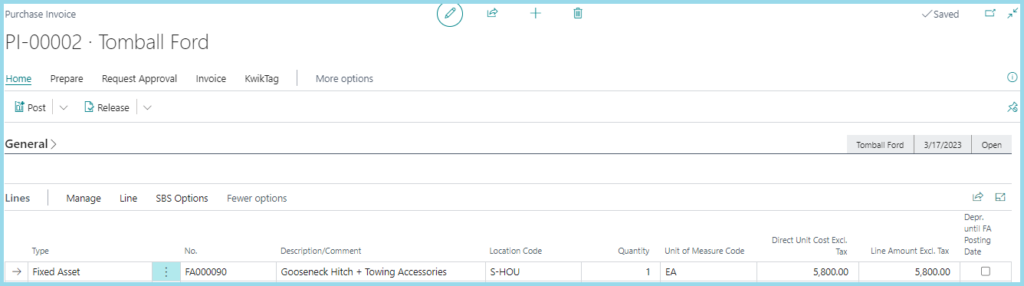

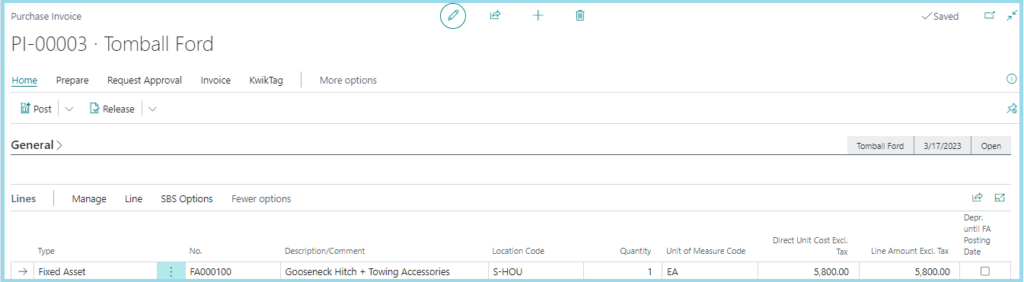

In March, we need to add a gooseneck hitch and towing accessories to each truck.

The total improvements per truck are $5,800 and will be acquired on March 17. The cost will not extend the useful life of the trucks.

The additional costs for each truck will be processed on a separate Purchase Invoice to illustrate how Business Central calculates depreciation under different scenarios.

In the first scenario, the User adds the additional cost to the Fixed Asset on the Purchase Invoice as it was entered for the original cost.

Default Depreciation Calculations for Fixed Assets with Additional Costs

When we calculate depreciation at the end of March, the first truck has a remaining useful life of 58 months, it has a beginning-of-the-month book value of $58,000, and we added $5,800 of capital improvements.

Theoretically, the March depreciation for this truck should be $1,100.

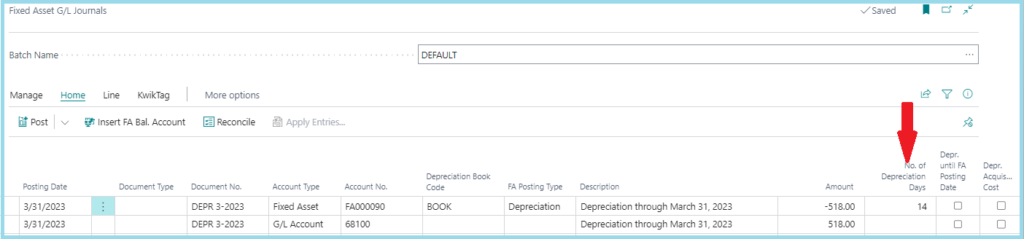

Using our default settings to calculate March depreciation for the first truck, we do not get a full month’s depreciation.

By default, when an additional Acquisition Cost is posted to a Fixed Asset, Business Central calculates the depreciation from the date of the last Acquisition Cost – the additional Acquisition Costs were posted on March 17.

Including March 17, there were 14 days remaining in March for the depreciation calculation.

If the Company has many Fixed Assets, and the User doesn’t identify Fixed Assets in the Fixed Asset G/L Journal that have less than 30 days of depreciation, the deprecation schedule for the asset has changed.

Going forward the monthly depreciation for this Fixed Asset will be [($58,000+$5,800-$518)/57] or $1,110 for the remainder of its useful life.

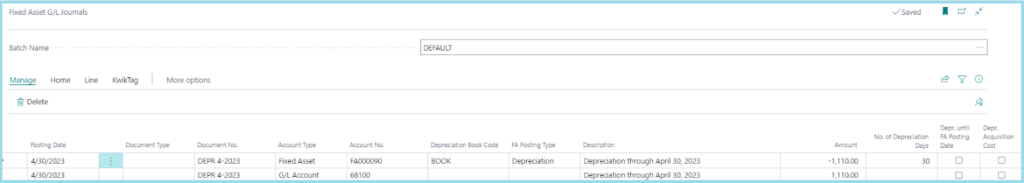

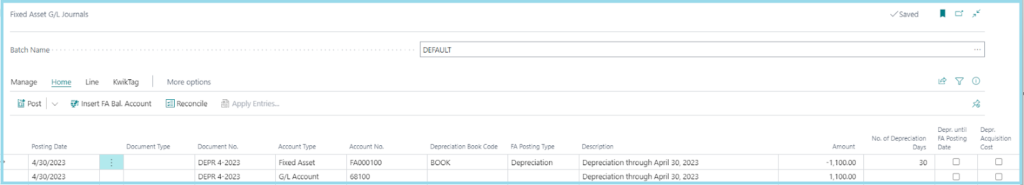

We can see this in the Fixed Asset G/L Journal after the depreciation is calculated for April 30, 2023.

Optional Depreciation Calculations for Fixed Assets with Additional Costs

We process the additional costs for the second truck as we did for the first truck.

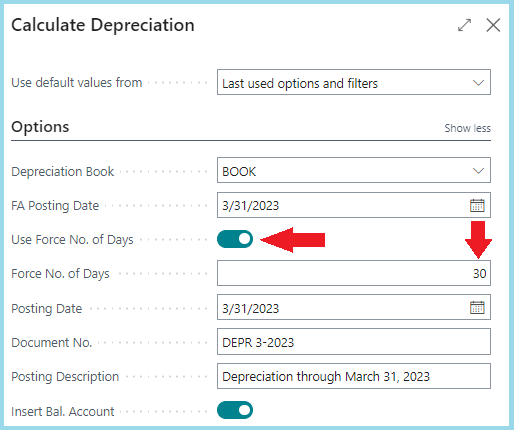

But when calculating depreciation for all the Fixed Assets, we identify those Fixed Assets in the Fixed Asset G/L Journal that do not have 30 days of depreciation and remove them from the Journal before posting depreciation for the Fixed Assets that have a full month’s depreciation.

We then calculate depreciation for those Fixed Assets that did not have a full month’s depreciation and we set the option for the “Use Force No. Of Days” to TRUE.

We also enter 30 as the value in the “Force No. of Days” field.

This will ensure you get 30 days of depreciation for those Fixed Assets with additional Acquisition Costs in the current period.

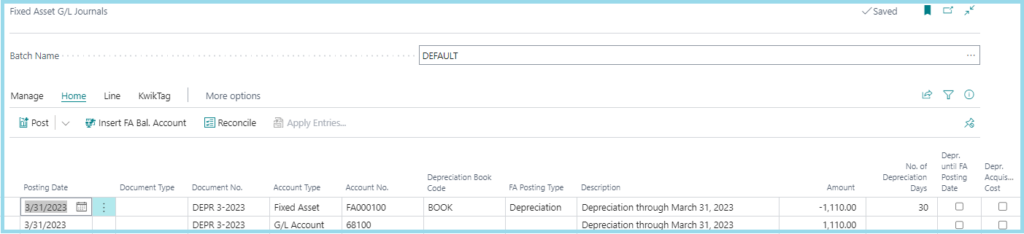

While this is slightly more than our theoretical calculation, the forcing of depreciation days gives us a full month’s depreciation.

And when depreciation is calculated for April, we’re back to the expected depreciation.

The extra $10 we depreciated in the month of acquisition will be absorbed over the next 56 months as the calculated depreciation is adjusted for rounding.

Recording Depreciation When the Additional Costs are posted to the Fixed Asset

While the second method for calculating and reviewing depreciation entries levels each Fixed Assets depreciation, there is yet another way to get the depreciation we expect.

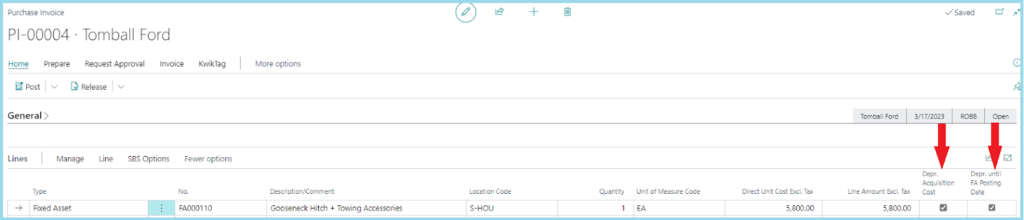

Before we post the Purchase Invoice for the additional Acquisition Cost for the third truck, we can place checkmarks in the “Depr. Acquisition Cost” field and the “Depr. Until FA Posting Date” field.

With a checkmark in the “Depr. Acquisition Cost” field, Business Central will calculate the catch-up depreciation for the Acquisition Cost on the Purchase Line.

The “Line Amount Excl. Tax” divided by the useful life of the asset times the number of days the original Acquisition Cost has been active – in this case, $5,800/1,800 days * 77 days, or $248.

With a checkmark in the “Depr. Until FA Posting Date” field, Business Central will calculate the depreciation for the original Acquisition Cost through the FA Posting Date – in this case, $60,000 / 1,800 days * 17 days, or $567.

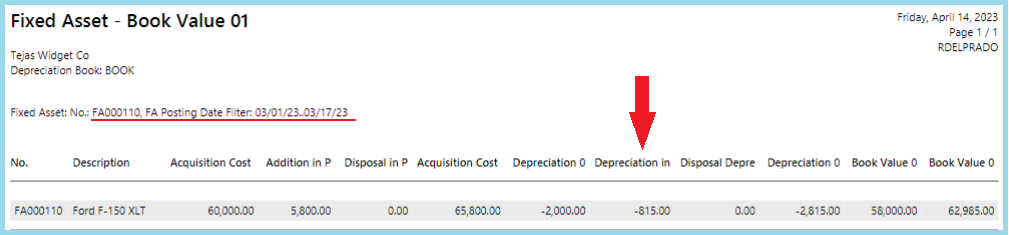

After posting the Purchase Invoice, our Book Value Report shows we have already posted $815 of depreciation for the third truck as of March 17, 2023.

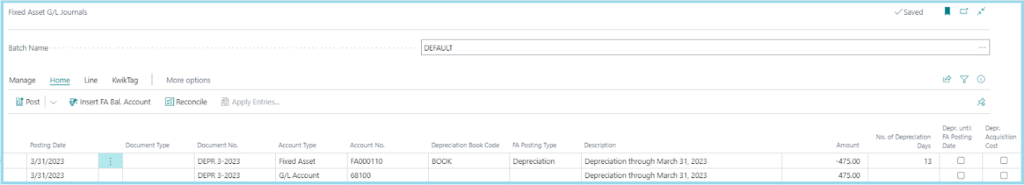

But we still need to post deprecation for the last 13 days of the month for the third truck and we do not need to force the number of days.

The depreciation for the rest of the month for the third truck is {$60,000 + $5,800) / 1,800 days * 13 days for $475.

Over the remainder of the truck’s life monthly depreciation will fluctuate from $1,097 to $1,096 based on the remaining balance and rounding.

But wait, there is still another option!

As we did with the Purchase Invoices for the first two trucks, we will not use the “Depr. Acquisition Cost” nor the “Depr. Until FA Posting Date” fields.

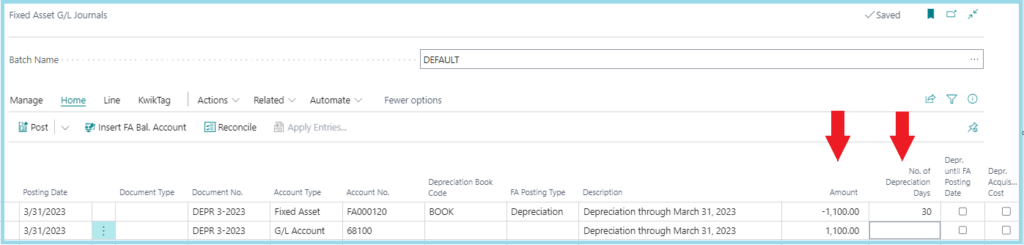

After calculating the monthly depreciation, we identify and remove from the Fixed Asset G/L Journal those Fixed Assets that do not have a full month’s depreciation.

Then after posting depreciation for the Fixed Assets with a full month’s depreciation, we can manually enter those Fixed Assets for which Business Central did not calculate the full month’s depreciation.

In the Amount field, we enter depreciation as a negative amount on the journal line with the Fixed Asset, but we also need to enter the “No. of Depreciation Days”.

We want to record a full month’s depreciation, so the value in this field should be 30.

By circumventing the standard calculations for the Fixed Assets with additional costs added after they’ve been placed in service, the depreciation expense for the fourth truck will be a consistent $11,000.

I’ve done many presentations on Fixed Assets and I’m always surprised at how many of the attendees have been using Navision, NAV, or Business Central for more than a couple of years and still have not implemented Fixed Assets.

With this case study, I hope you’ll consider implementing the Fixed Asset functionality in Business Central, trashing those error-prone spreadsheets, and using standard Business Central functionality to calculate both their Book and Tax depreciation.

If you don’t know how to start your implementation of Fixed Assets in Business Central, get in touch today.